Record Break – Bajaj Housing Finance ipo became 1st Company to Cross ₹2,00,000 Crore Subscription

The Grey Market Premium (GMP) for the Bajaj Housing Finance surged on the final day of subscription, reflecting a premium of over 92 percent in the unlisted market. This strong demand indicates positive investor sentiment ahead of the company’s listing.

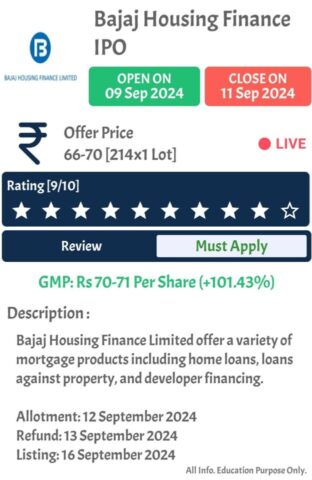

Bajaj Housing Finance IPO Details

The Bajaj Housing Finance has seen overwhelming demand on the final day of bidding, being subscribed nearly 63 times as of September 11. it, worth Rs 6,560 crore, received bids for over 4,564 crore shares against the 72.75 crore shares on offer, with the total bid amount exceeding Rs 3 lakh crore. This marks one of the largest subscription amounts in India’s IPO history, surpassing even notable IPOs like Coal India Ltd (2008) and Mundra Port (2007).

it includes a fresh equity issue worth Rs 3,560 crore and an offer-for-sale (OFS) of Rs 3,000 crore by parent company Bajaj Finance. The listing is in line with RBI regulations, which mandate that upper-layer non-banking finance companies must be listed by September 2025. The proceeds from the fresh issue will be used to strengthen the company’s capital base for future needs.

Bajaj Housing Finance IPO Subscription Status

Institutional investors have shown strong interest, with the Qualified Institutional Buyers (QIB) portion being subscribed nearly 207 times, while the non-institutional investors’ quota was subscribed 41 times. Retail investors also participated actively, with the Retail Individual Investors (RII) quota receiving around 7 times subscription.

Earlier, it had garnered 7.51 times subscription by the end of Day 2 and was fully subscribed within hours of opening on Monday. Bajaj Housing Finance had already raised Rs 1,758 crore from anchor investors prior to the public issue.

Bajaj Housing Finance IPO GMP

On the last day, the Grey Market Premium (GMP) for Bajaj IPO GMP rose to Rs 70-71, reflecting a premium of over 100% in the unlisted market due to high demand for its shares.

Bajaj Housing Finance Allotment Date

it’s allotment date is the day when it registrar makes the allotment status public on their website. The allotment status informs investors of the number of shares they’ve been given in an IPO.

Steps to Check Bajaj Housing Finance IPO Allotment Status:

To check the Bajaj Housing Finance IPO allotment status online, follow these simple steps:

Step 1 – Click on the “Check IPO Allotment Status” button below.

Step 2 – From the dropdown menu, select the company’s name.

Step 3 – Enter any one of the following details:

Step 4 – PAN Number

Step 5 – Application Number

Step 6 – DP Client ID

Step 7 – Hit the “Search” button to get your allotment details.

If you’ve been allotted shares, the equivalent number of shares will be credited to your Demat account shortly after.

Contact KFin Technologies for Assistance

For any queries or concerns regarding the Bajaj Housing Finance allotment, investors can reach out to KFin Technologies Limited via phone or email. Contact them by sending an email with all relevant details to bhfl.ipo@kfintech.com

One thought on “Bajaj Housing Finance ipo became 1st Company to Cross ₹2,00,000 Crore Subscription”